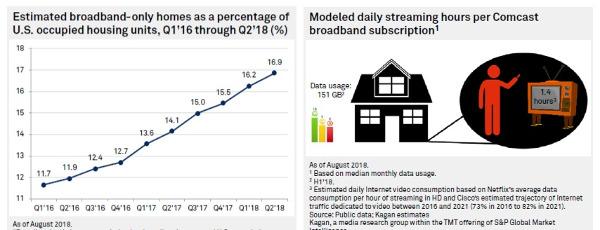

Survey: Internet-Only TV Households Reach 17%

The number of internet-only homes that do not subscribe to a traditional cable TV package has reached a new record high, according to new research from Kagan.

Previous studies have shown that millennials figure prominently into these households, which have either unsubscribed from cable TV — referred to as “cutting the cord” — or never subscribed in the first place, so-called “cord nevers.”

An estimated 16.9% of U.S. households were “broadband-only” in the second quarter, up nearly 3% year-over-year, according to the Kagan data as reported by S&P Global. Broadband-only homes are defined as “broadband-connected U.S. occupied households without a traditional multichannel video package.”

The analysis described the increase in broadband-only homes as a boon for broadband ISPs based on the assumption that the “vast majority of those households fill their video needs with online services,” which suggests increased data consumption.

Comcast, for one, reported that median monthly data usage among its Xfinity.com custom base was 151 GB the first six months of 2018, compared with 100 GB in the same period a year earlier and 131 GB in the second half of 2017 (chart on right).

In related news, Parks Associates recently reported that the rate of cancellations for internet (a.k.a. OTT) video services among U.S. broadband households has held steady over the past three years at approximately 18%.

Parks pegs the average subscription length at 30 months overall and says “OTT service penetration” is starting to plateau at around 65% among U.S. broadband households. The three top streaming services — Netflix, Amazon, and Hulu — are the most stable in terms of “churn rates.”