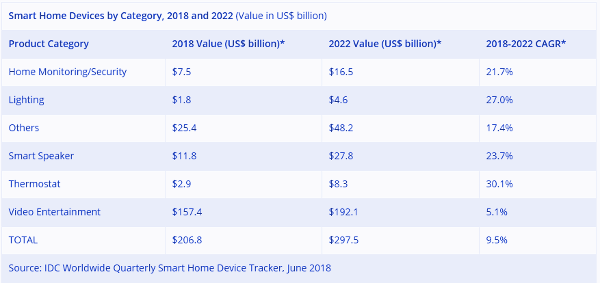

IDC: Video and Smart Speakers Lead the Smart Home

Market research company IDC is forecasting that some 550 million smart home devices will ship worldwide this year, a 27 percent increase over 2017.

Smart speakers and video entertainment are leading the way and expected to capture almost three quarters (71 percent) of the market in 2018, according to IDC’s Worldwide Quarterly Smart Home Device Tracker, which is forecasting an annual growth rate for these categories of 12 percent through 2022.

IDC says video entertainment, a category comprised largely of smart TVs and digital media adapters, will dominate during the forecast period.

"With TVs being the centerpiece of many homes, device and platform makers are competing for users' attention with the inclusion of smart assistants and other over-the-top services," said Jitesh Ubrani, senior research analyst for IDC Mobile Device Trackers. "While Amazon's Alexa leads in this space today, the Google Assistant is expected to gain dominance in the future as an increasing number of international brands include support and consumers' familiarity with the Assistant on smartphones leads to growing demand for the Assistant on TVs."

Overshadowed by the exploding smart speaker category, the number of smart assistant-enabled TVs and digital media adapters remains relatively small today but the trend is expected to shift in the near future as more brands come to market with smart assistant-embedded entertainment devices, IDC said, citing the recent release of Amazon's Fire TV Cube with Alexa and Google Assistant-equipped TVs from LG as examples.

"The race for dominance in the smart speaker segment is becoming fierce," explained Adam Wright, senior research analyst for IDC's Consumer IoT Program. "Smart speakers are one of the primary modes of access to a smart assistant, and consumer awareness and adoption of these devices and platforms is increasing rapidly thanks in large part to extensive marketing campaigns by Amazon, Google, and Apple.

“Amazon's portfolio of Alexa-enabled speakers continues to represent the lion's share of the market, but Google is gaining momentum and showing signs of closing the gap rather quickly. Apple, on the other hand, is struggling to get out of the gate with sluggish HomePod sales and shipments — in part due to the device's high price point and Siri's inferior performance as a smart assistant platform compared to Alexa and Google Assistant."

Beyond video entertainment and smart speakers, IDC expects tremendous growth in the home monitoring/security category as Amazon's recent acquisition of Ring drives consumer prices down. Meanwhile, Google's move to maintain Nest as a premium, subscription-based service will hinder growth in the short term as consumers struggle to see the benefits of recurring payments.

However, as the market evolves, subscription services from the likes of Nest or other smart home products are likely to steal share from traditional home monitoring service providers, IDC said, noting that connected thermostats, smart lighting, and other products will round out the rest of the smart home market.

Growth in these categories is expected to be around 25 percent through 2022 as these products tend to be consumers’ second or third smart home purchase.