The disturbing trend I'm seeing is that all of the content providers seem to be coming up with their own streaming services. Are we going to have to subscribe to dozens of services?

Survey: ‘Multi-Service Usage’ the Norm for TV Viewers

With a seemingly endless parade of programming from an ever-expanding variety of services, the days of getting TV from one source are long gone as “multi-service usage” becomes the norm.

That’s just one of the many findings from TiVo’s just-released Video Trends Report, which revealed that the typical American household is well on its way to getting TV from three different services (pay TV, internet TV, etc.) The survey found respondents using 2.75 services in 2018, up from 2.18 in 2017 — an increase of 26%.

The survey also showed that the three top “consumer-generated bundles” include a combination of pay TV, free services, and subscription video on demand (SVOD). Bundle No. 1 (10.6%) included Netflix, Prime Video, and pay TV, which was followed by Facebook/YouTube/pay TV (7.5%) and YouTube/Netflix/pay TV (7.5%)

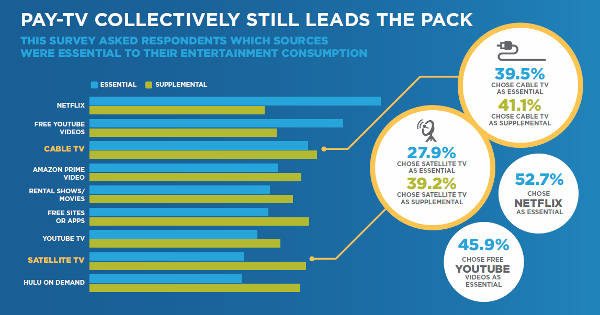

When asked which video sources they considered “essential,” most respondents (not surprisingly) chose Netflix (52.7%), followed by free YouTube (45.9%) and pay TV (39.5%). Survey participants were also asked to pick “supplemental” video sources and 41.1% cited traditional pay TV, making it the collective leader of the pack. Satellite TV had the second highest collective score with 27.9% of respondents citing it as “essential” and 39.2% naming it “supplemental.”

Interestingly, almost a third (30.7%) of those surveyed aren’t using any major monthly internet (a.k.a. OTT/over-the-top) or SVOD service. “As service clustering increases, it’s important to note that a sizable portion of respondents are still ‘cord-only’ users,” TiVo said, noting that this group tends to be older.

The upshot is, consumers are using a variety of services, and with the exception of several ever-popular categories, such as pay-TV and Netflix, they’re not flocking to any particular content providers or services. Instead, consumers are demanding more content from more sources than ever before.

One finding that may surprise some is that live TV still has plenty of juice, with 63.6% of survey respondents saying they watch one or more hours of live TV accessed from a channel guide every day. This was followed by 52.2% who reported watching one or more hours of OTT/subscription services, 51% watching an hour or more of previously recorded “DVR’d TV,” and 45.6% watching an hour or more of live sports. Only 10% indicated that they don’t watch live TV on a regular basis.

- Log in or register to post comments