Which of the New TV Technologies Will Prevail? Page 2

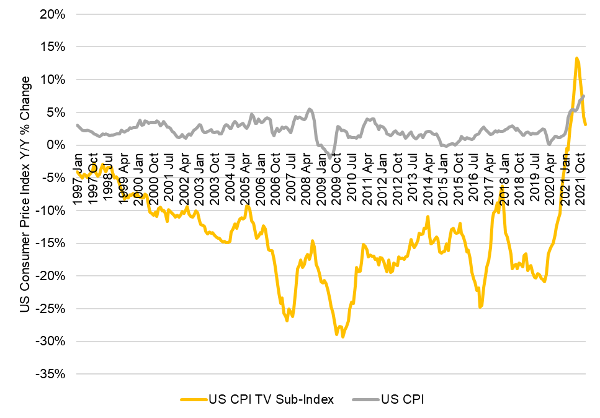

O’Brien: There was a surge in demand for TVs during the pandemic but because supply was constrained the cost of LCD TV panels increased dramatically, rising more than 100% from mid-2020 to mid-2021. This drove retail prices up for the first time in at least 40 years. I’ve been in the display industry since the 1980s and TV prices always went down — until the pandemic. The U.S. Consumer Price Index has a sub-index for TVs, which shows that TV price inflation peaked at 13.3% in August 2021 (see chart below).

Fortunately for consumers, the display supply chain caught up to demand and LCD TV panel prices have been declining since last summer and retail TV prices are following. So it appears that 2022 will revert to the traditional pattern of declining TV prices. In 2021 we did see the higher prices suppress demand, and we hope that lower prices in 2022 will bring people back to the stores.

S&V: Samsung announced MicroLED screen sizes above 100 inches and LG recently announced a 97-inch OLED TV, which raises the question of how big direct-view screens will get? Is there a limit or size beyond which manufacture becomes impractical? And when do you see the biggest direct-view TVs — over 85 inches — becoming affordable for a sizable segment of the TV buying public?

O’Brien: There is effectively no limit to MicroLED size, since these are inherently tiled. Direct-view MicroLEDs are basically a derivative of the LED displays you see in stadiums, Times Square, Las Vegas, etc. that can be hundreds of feet wide. The limitation for MicroLEDs, as I mentioned, is that they are not affordable now and not likely to be affordable in this decade. In OLED and LCD, the 97- or 98-inch panel is an efficient size to produce on existing fabs. Of course, the logistics of handling those big displays can be daunting, but from a technology standpoint a 98-inch LCD TV should not cost more than four times as much as a 49-inch LCD TV, since they have an equivalent screen area. Remember, screen size is measured diagonally, not by area, and the screen shape is always 16:9, so if you double the screen’s diagonal measurement, you double the width and you also double the height so the area goes up four times [area = width x height].

As of now, 97 inches is likely the limit for OLED TVs but for LCD TVs we could see panels as large as 130 inches. There are several fabs in China that can produce that size panel efficiently. As for how long it will take for the prices to come down, that depends on several factors. Probably the biggest factor is volume — with low volumes you can't achieve economies of scale. The consumer’s appetite for very large TVs (over 85 inches) is limited by factors other than price; many people do not want a big screen dominating their living space. So for the time being, these volumes will be more limited and prices will be correspondingly higher.

S&V: Ultra-short-throw (UST) projectors are still relatively new and have been generating a fair amount of buzz. Do you see USTs giving the biggest direct-view TVs a run for their money?

O’Brien: I've been impressed with the picture quality of USTs, and I believe they are a great option for very large screens — greater than 100 inches — in dedicated home theater setups. Projection displays provide the best value for really big screens but I don't see USTs competing in screen sizes smaller than 100 inches sizes where LCD and OLED dominate.

S&V: What's your take on the market for 8K TVs and, more to the point, content? When do you see 8K hitting stride?

O’Brien: I think 8K content, while it will continue to increase, will remain a niche for years to come. 8K is a great advancement for those very large screens we've been discussing — greater than 85 inches. Even without native 8K content, advancements in upscaling technology, including the employment of Artificial Intelligence (AI) in upscaling, has allowed these TVs to take advantage of the higher display resolution even without native content.

S&V: Chinese brands such as TCL and Hisense continue to make considerable inroads in the U.S. TV market. Does China’s impact on the domestic market extend beyond pricing and, if so, how/where?

O’Brien: I've been impressed with TCL's push to Mini-LED technology and TCL is a vertically integrated company with its own display division. If you look at the history of TV, the leading brands always had their own display business and pushed display innovation. This goes back to RCA in the 1950s and 1960s with the introduction of color, to Sony in the 1970s and 1980s with Trinitron and later the WEGA flat CRT, to Samsung with its LCD innovations and, more recently, LG’s with its WOLED innovations.

S&V: To sum up, what are the top TV trends you see over the next five to 10 years, and what impact will they have?

O’Brien: I see a three-way technology battle at the top of the market between QD-OLED, WOLED, and Mini-LED (with MicroLED in a world all its own). I expect that pricing will go in that order — highest to lowest — but the product range in terms of screen size offerings, resolution offerings, and brand offerings will be in reverse order with QD-OLED being the most limited and Mini-LED being the most ubiquitous.

Now that the effects of the pandemic have waned, I also expect to see the normal pattern of prices going down over time to resume and, with technology and brand battles, we may see more aggressive prices. It's going to be a great time for consumers to buy fantastic TVs at affordable prices.

S&V: Is there anything else you’d like to share?

O’Brien: Keep buying big TVs!